Amarkets: The best strategies and patterns for cryptocurrency trade

today there are almost 19 thousand cryptocurrencies in the world. On the one hand, these are great opportunities! For comparison: only a few thousand companies are represented on one of the largest world stock exchanges – New York Stock Exchange (NYSE). On the other hand, such a wide selection can embarrass any novice crypto trader. Where to start selling cryptocurrencies? How to choose the best cryptocurrencies for trading? What cryptocurrency trading strategies are suitable for beginner traders? We understand the article below.

cryptocurrency trade: where to start?

we offer not to delve into theory and immediately move on to trading practice. How to trade effectively? To analyze the actions of professional traders and first repeat after them.

Professional traders are divided into two categories for the type of search for trading signals:

professionals in technical analysis. These include those who, when making decisions for the most part, are guided by technical analysis and on its basis can open transactions Almost any cryptocurrency tool. Masters of trading in narrow cryptonshi are narrow -oriented specialists who study key trends in the framework of several crypto tools and open transactions mainly when fundamental reasons appear.

, inherently, cryptocurrency trading for beginners is no different from professional trading. Both others open and close the purchase and sale transactions with the aim of earned speculative profits. The only difference is that Professional traders more stably receive income.

Training of cryptocurrency trading: basic principles

Fundamentals of cryptocurrency trading are practically no different from classical trading in financial markets. In other words, a professional trader in the Major currency pairs market – EUR/USD, GBP/USD, AUD/USD and others – will be able to quickly understand key cryptocurrency technical and graphic models.

Consider a simple algorithm for trading cryptocurrency, and below In the article we will analyze the best cryptocurrencies for trading and effective trading strategies.

The choice of a timeframe for work

is it more convenient for you to open a deal and keep it open a couple of days, or do you prefer scalping? In the first case, sell M30, H1 and H4 at timeframes. In the second – M1, M5 and M15. In this case, “m” means “minute”, and “h” – “hour”. Accordingly, “M15” indicates that each candle discussed in the schedule contains information in 15 minutes.

Many novice traders ask the question: “What The best timeframe for cryptocurrency trading? “The answer is simple:” The one that is most convenient for you. ”

on average on the screen-depending on its size, 350-450 candles are placed. Therefore, if you open the H1 timeframe, then you will immediately be you History has been available over the past 18 days. If M1 is over the past 8 hours. The larger timeframes you choose – H4 larger than H1, the more accurate information you get when analyzing the schedule.

Focus on specific cryptocurrencies

to start to start Choose a few tools and study them thoroughly: who created them and why; What is their average trading range for the period; What are the prospects for their further use. Even if you do not plan to immerse yourself so deeply in every cryptocurrency in the future, at this stage you can determine the main factors that you are comfortable considering when making decisions on the opening and closing of positions.

The search for the best patterns on historical data

determine on historical data, which patterns “work” better. This is You can do it manually or using automated programs.

, the program constantly analyzes dozens of trading tools for the appearance of graphic patterns and, when forming, signals this to the trader.

To get free access to the AutoChartist trading signals, just:

Open the Amarkets personal account and in the “Services” window, click on the trading signals icon.

Testing patterns on real data and earnings

Find these patterns In real time and earn. Traiders using mainly technical analysis believe that history is repeated. Therefore, if you have already identified on historical data that specific analytical models using indicators or graphic patterns have perfectly signed the continuation or turn of the trend – test them in practice.

doubt the developed strategy? Feel free to test it on a demoschet without risk using real quotes!

The best cryptocurrencies for trading

will allocate the top 5 cryptocurrencies for trading, which you can trade right now.

Bitcoin (BTC/USD). The popularity of Defi projects, the development of NFT infrastructure, the legalization of Bitcoin Salvador as an official payment fund, the launch of the first ETF on the US exchange – all this should ensure a significant increase in the Bitcoin course in 2022. Ethereum (Eth/USD). According to the data as of April 19, 2022, Ethereum is the second after Bitcoin the largest cryptocurrency in terms of market capitalization – Almost $ 375 billion. Experts are inclined to the fact that in the long run the Ethereum is one of the most promising cryptocurrencies due to the volume of tokens and the breadth of opportunities: not only storage and departure of funds – as in the case of BTC/USD, but also investment , deposit and other actions. Ripple (XRP/USD) was created to increase the efficiency and speed of interbank transactions using blockchain technology. The ripple course is growing by increasing the number of unique addresses, sale of new products and periodic redemption of tokens from the company itself. Stellar (XLM/USD) stimulates the simplification of cross -border monetary operations. Technically, the cost of one coin is now quite low: for updating the historical maximum, it needs to grow by 270%, while bitcon is only 65%. Cardano (ADA/USD) is one of the most promising assets in the Defi sector. With its help, it is planned to upgrade the education system in Ethiopia. In addition, Cardano can be used in financial sector, trade and healthcare.

Patterns in cryptocurrency trading

before moving directly to the description of graphic patterns, we will consider a very important concept, about which many forget: the correlation between trading instruments.

The correlation between cryptocurrencies

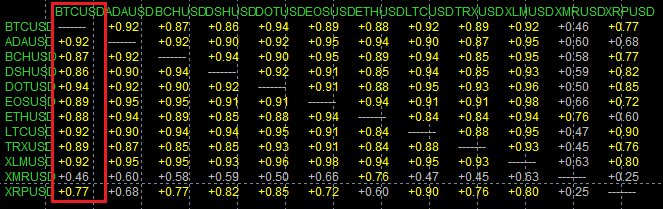

correlation is the degree of relationship between the considered cryptocurrencies. It can vary from -100% to 100% (or from -1 to 1). High positive correlation indicates that the value of assets is moving Change in the way or almost identical. Correlation between cryptocurrency quotes based on 300 candles H4 from 04/18/2022. Metatrader Trading terminal. Application date: 04/18/2022.

in the figure above the red rectangle is a correlation between BTC/USD and other cryptocurrency tools. 10 out of 12 cryptocurrency pairs have a correlation with bitcoin at least 87%. In this case, this indicates a very high dependence of the course of these cryptocurrencies on the BTC/USD dynamics. A similar correlation is observed between oil brands Brent and WTI, which are almost a single asset. In other words, a high positive correlation between crypto actures indicates their interdependence. As a result, the BTC/USD dynamics schedule is primary when analyzing cryptocurrencies, as most of them repeat the bitcoin movements.

Fibonacci in cryptocurrency trading

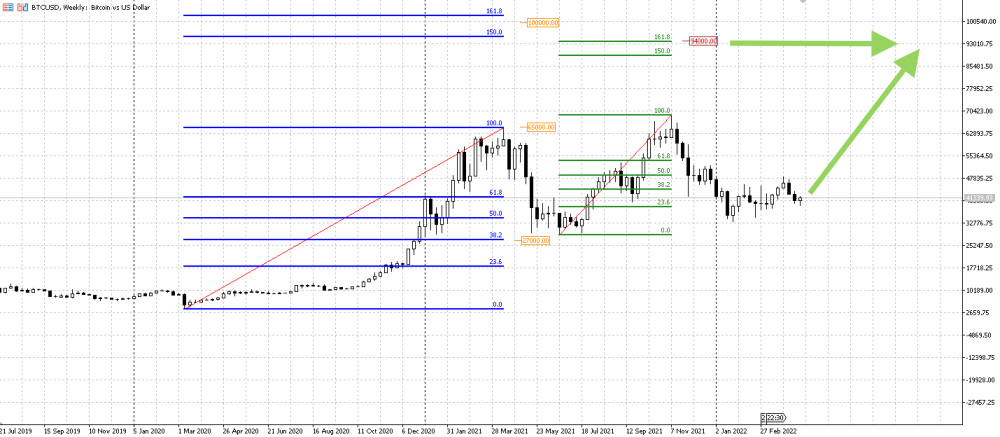

Consider one of the most popular and from this no less effective tools for forming TAKE Profit and Stop Loss in trading cryptocurrencies – Fibonacci line (Fibonacci Retraacement). Fibonacci levels are targeted guidelines that are used by traders around the world. The levels themselves are a set of values: 38.2%, 50.0%, 61.8%and others.

higher on the schedule of the Bitcoin course is an example of using fibonacci levels. The levels of bitcoin growth from the end of 2020 to April 2021 Green have been drawn in the blue ruler – from June to November 2021. The blue line was quite effectively predicted by the depth of correction: a level of 38.2% at a price of $ 27,000, in the zone of which later and later and later and Sent BTC/USD price.

Why is it forecasting the cost of bitcoin $ 100,000?

on the one hand, this is a round number – markets love round levels. On the other hand, $ 100,000 is located near 150% and 161.8% of the blue line. To be more accurate, at the intersection of a blue level of 150% and green 161.8% is the price of $ 94,000 (shown by green arrows). As part of this analysis, it is a more accurate target level than a value of $ 100,000.

Why is it relevant to use Fibonacci tools today? Because the majority Cryptocurrencies do not have a long trade history. Traders need approximate guidelines for calculating the “profit/risk” coefficient and the formation of trade strategies. That is why many of them use the Fibonacci line.

platforms for trading a cryptocurrency

platform for cryptocurrency trading – this is a special program that allows the user to open, modify and close transactions for the purchase and sale of cryptocurrency tools. For example, to open a transaction by Litecoin (LTC/USD), You need to open an account and connect to the trading platform. Next, in this platform you need to select the desired cryptocurrency, analyze the quotation schedule and make a decision on the transaction.

platforms are different: universal and highly specialized. The latter are created on the basis of specific brokers and exchanges and have narrowly -fired functionality of work within the framework of the presented trading instruments. The first – allow you to work with almost any assets regardless of the fast crypto exchange and broker.

much It’s easier to get acquainted with the platform once and use it in a variety of markets than to constantly “retrain”: remember the functionality of new platforms and get used to their interfaces.

one of these universal platforms is Metatrader 5 – one of the most widely used trading terminals in the world.

Use the advantages of Metatrader 5 for earnings:

Market and delayed orders of six types; extended glass of prices; the possibility of hedging of open positions; Free indicators and trading advisers; built -in economic calendar and updating market news in real time; Trade in a mobile application and browser.

Test all the capabilities of Metatrader 5 to trade cryptocurrency on the Amarkets demoschet! You will receive $ 10,000 virtual funds and access to real quotes. Test strategies and trade ideas without risk!

Effective strategies for cryptocurrency trade

despite the fact that earnings within the framework of cryptocurrency tools are possible Both with the growth of quotations and when they are reduced, the essence of cryptocurrency trade is reduced to find assets that have a high growth potential in the near future. In this sense, investing in cryptocurrencies is similar to investments in the action. Consider two strategies.

Strategy No. 1. Favorable following bitcoin

from July to October 2021. The cost of bitcoin increased by 135%. During the same time, the Polka Dot cryptocurrency (Dot/USD) showed an increase of 440%. In the following months, both assets returned to the July values. This An example indicates that if the cost of BTC/USD will increase by 160% to $ 100,000 already in 2022, then during the same period the DOT/USD rate can rise by about 550% to $ 115.00.

We also note that these cryptocurrencies have a different nominal value. In other words, for $ 1000 you can buy about 0.026 BTC and as much as 57.6 DOT for the rate on 04/25/2022 – 2215 times more.

similar “increased” profitability can be given by other cryptocurrencies. For example, SOLANA (SOL/USD) and Dashcoin (DSH/USD).

Strategy No. 2. Playing graphic patterns

cryptocurrencies – Sufficient young trading instruments by the standards of the existence of financial markets. Their trading ranges have not yet been fully formed. Therefore, traders and investors need some guidelines for opening and closing positions. Many use classic graphic models and technical indicators to trade cryptocurrency.

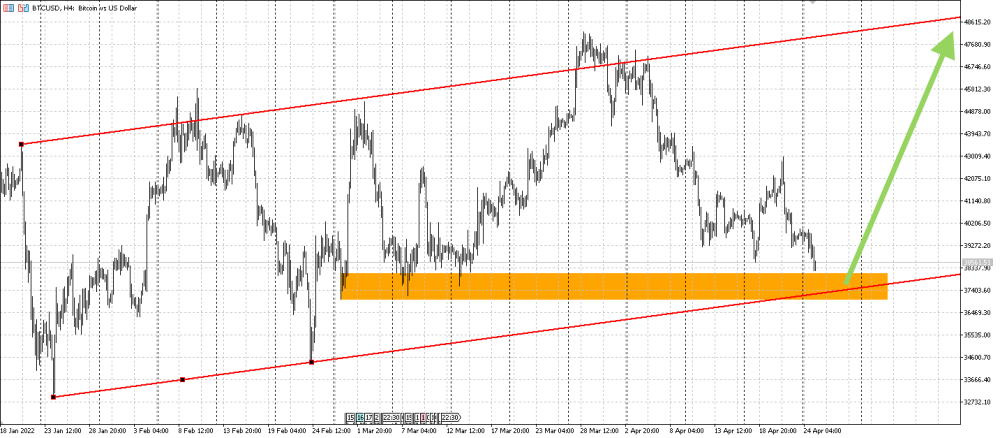

in the figure above shows the dynamics of the cost of one bitcoin in US dollars. In red lines, the price channel is illustrated, within which the BTC/USD course moves The last three months, quite confidently bouncing from the boundaries: more than 95% of the quotes are inside the channel.

Orange line characterizes the local support level formed earlier due to price accumulation: $ 37,000- $ 38 100. If the quotes continue to move in a given range, you can expect a rebound from this level of support with goals of $ 48,000 and higher. This analysis is a clear example of how easily and successfully cryptocurrency quotes “work out” even simple graphic patterns.

The world of cryptocurrencies is so wide that no one can fully call himself the formed professional of the entire industry – everyone will find new areas for development. Moreover, new cryptocurrencies appear quite often. Thanks to this, every novice cryptotrader who has begun to develop today can soon become a professional in a narrow niche and earn stably.